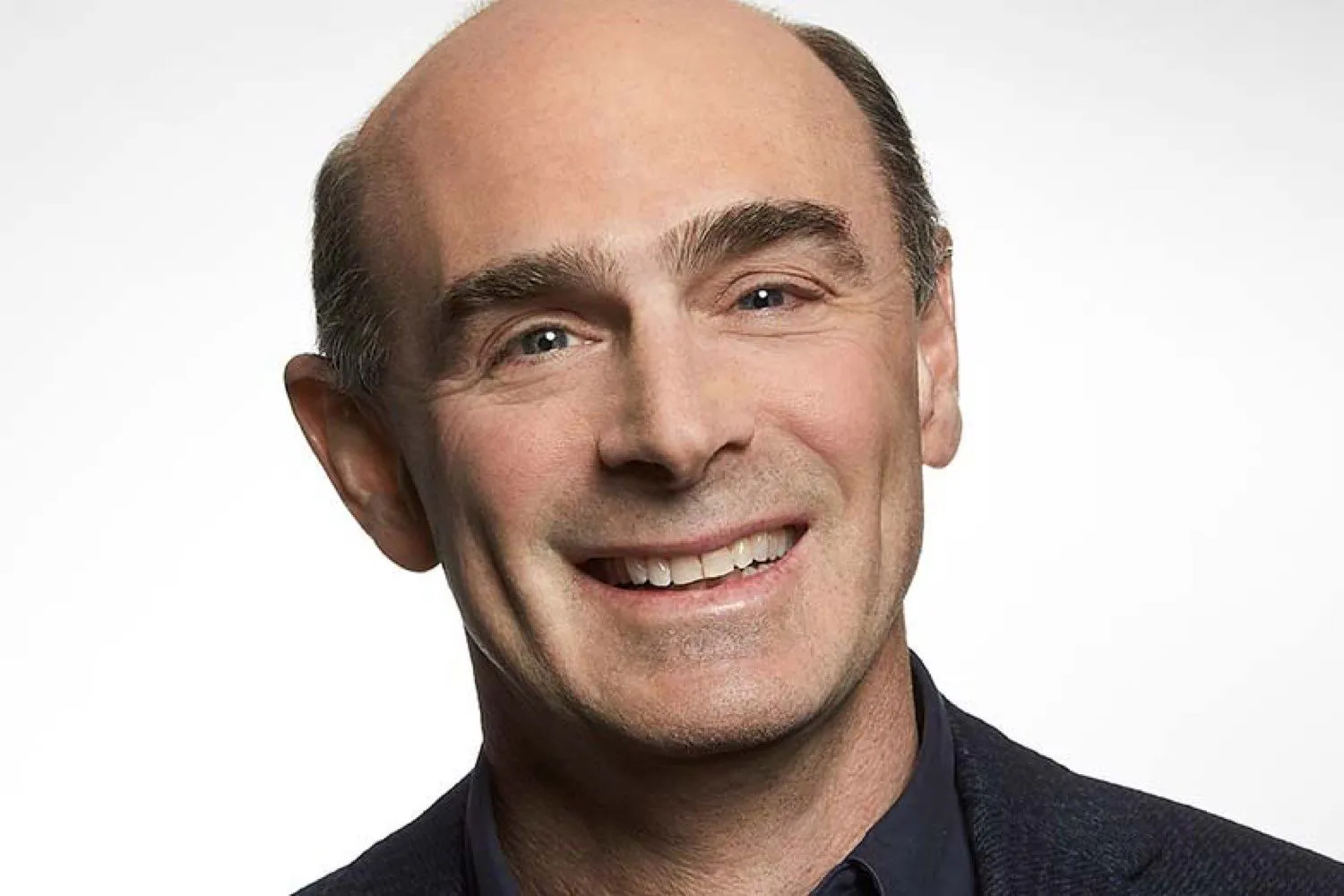

Ted Schlein

Partner and Advisor

Ted Schlein is a partner at Kleiner Perkins, and executive chairman and founding partner at Ballistic Ventures. He has spent the last 35 years helping create transformative companies.

A Midas of investing and the former chairman of the National Venture Capital Association (NVCA), Ted has funded, supported, and guided more than 30 founders to successful company exits including ArcSight, Chegg, Fortify Software, IronNet Cybersecurity, Jive, LifeLock and Segment. He currently serves on the boards of Apiiro, Bedrock, Chegg (CHGG), FullStory, Interos, Incorta, IronNet, Rebellion Defense, Reputation, Synack, Trusona and UJet.

Ted has a wealth of experience in both the private and public sectors, especially when it comes to cybersecurity and technology infrastructure. As a founding CEO of Fortify Software, which was later acquired by HP, he helped lead the development of key cybersecurity solutions. His time at Symantec, where he spearheaded their antivirus efforts, established him as a leader in software security, particularly with the launch of a commercial antivirus solution that set a new industry standard.

His work as a member of the Board of Trustees at the National Security Agency and at InQTel, highlight his strategic vision in both business and policy decisions, where his deep understanding of technology, security, and market trends places him at the forefront of cybersecurity.

Ted serves on the Board of Trustees at the University of Pennsylvania, his alma mater, where he earned a bachelor’s degree in economics.

Awards and Honors

- NSA Advisory Board

- CISA Cybersecurity Advisory Committee

- Homeland Security Advisory Council, National Security Institute Advisory Board

- Council on Foreign Relations

- Independent Task Force on Cybersecurity

- Board of Trustees at InQTel

- Board of Trustees of University of Pennsylvania

- Dean of Advisors of Engineering School at University of Pennsylvania

- National Venture Capital Association (NVCA)

- Western Association of Venture Capitalists