Kleiner Perkins is committed to respecting and protecting your privacy; please contact [email protected] with any questions regarding our privacy practices.

© 2024 Kleiner Perkins

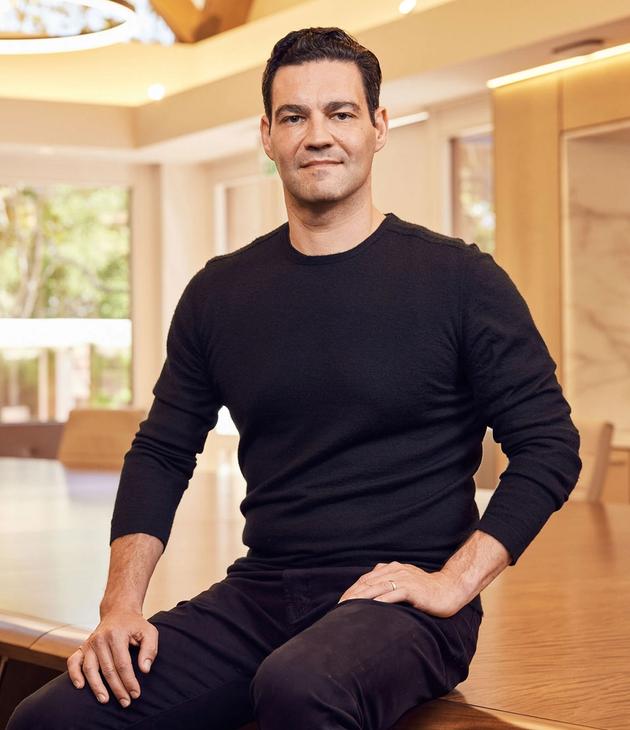

Ilya Fushman is a partner at Kleiner Perkins. He invests in early and growth stage companies across enterprise software, financial services and consumer software. He has invested in and sits on the boards of companies including Rippling, Motive, Stord, Productboard, Loom, Cameo, and has previously backed companies such as Slack and Intercom. Prior to Kleiner Perkins, he was a general partner at Index Ventures, and previously led Dropbox’s product organization. Ilya holds a PhD in Applied Physics and MS in Electrical Engineering from Stanford and a BS in Physics from Caltech.

Investment focus areas

— Enterprise software

— Consumer technology

— Fintech

— AI

I come from an academic family and wanted to become a scientist in order to create things that hadn’t been built before. So I pursued this path and studied physics and electrical engineering at Caltech and then Stanford.

At Stanford I was exposed to the magic of Silicon Valley for the first time. I realized that venture and startups presented an alternative path to impacting the world in ways that were similar, and potentially bigger than academic research.

After finishing my PhD, I had the opportunity to be part of Solar Junction, where we built the world’s most efficient solar cell, and eventually landed at Khosla Ventures. There, I learned two things. First, venture was my long-term calling. Second, I had to experience hyper growth myself.

I was lucky to join Dropbox in 2011, when the company was just over 50 people, and saw it grow to 1,500 people in just over four years. At the end of that journey, I felt like I was ready to come back to venture. I love building, but I love helping others build even more.

In 2015, I joined Index Ventures as a General Partner to help build out the San Francisco office. It was a wonderful time, and I had the opportunity to not only help build out the US presence, but also invest in industry-changing companies such as Slack, Intercom, Optimizely, Culture Amp, KeepTruckin, Nova Credit and more.

I’m now even more excited to continue building at Kleiner Perkins. We live in an age of extreme technological transformation, and I want to be part of shaping the future.

I was born in Russia (still the USSR then) and immigrated with my family to Israel, then Germany, and eventually settled in the US. My parents took a massive risk, leaving everything behind each time we moved. I had to start fresh four times in the span of a few years—learning a new language, making new friends, and adapting to new situations quickly.

Building companies isn’t dissimilar to taking immigration-scale risks. It’s all about a leap of faith, starting fresh, and the willingness to go all in on your ideas. It’s about betting on people and their ability to adapt. I’ve found that I’m drawn to the kinds of founders who take risks, are adaptive learners, and are hungry to build things that will make a dent in the world. My childhood experiences have given me a deep empathy for this.

When I started at Dropbox, I led the corporate development team. This meant everything from acquisitions to partnerships, and to products related to those. A year in, I transitioned to a product leadership role. I oversaw the team that built and launched Dropbox for Business, the Developer Platform, the core Dropbox product, and some of the early efforts in collaboration.

There are many parts of this experience which are transferable to both the venture process and to startups. Companies going through hyper-growth across all industries experience similar challenges: from decision making, to organizational design, to product strategy and development, and more. Seeing and building Dropbox through this time period was the equivalent of a crash course in all of these.

Dropbox is a frontier company. It spans both consumer and enterprise. It’s developed a novel growth model, where viral consumer growth fuels the enterprise business. It’s a company where the product experience is central to success. It’s built one of the largest computing infrastructures in the world. I believe that many other companies will be built in similar ways, not just in technology but in large industries such as finance, transportation, real estate, healthcare and more. This informs a lot of my thinking about investment areas.